68-Percent app for iPhone and iPad

Developer: John Jacobsen

First release : 15 Mar 2013

App size: 2.61 Mb

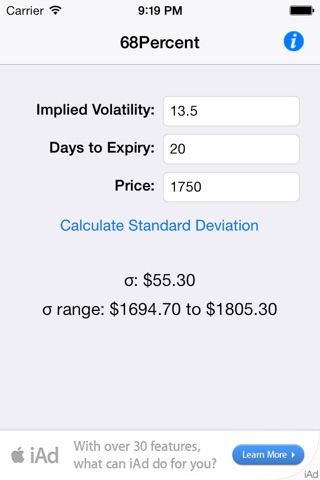

68 Percent is a quick standard deviation calculator to help determine an expected range that an equity or option will trade in over a period of time. 68 Percent should not be used to create trades, rather used as a litmus test to verify ranges that could affect a particular trading strategy

Is statistics and probability theory, standard deviations show how much variation or dispersion exists from the average. One standard deviation (sigma) is +/- 34.1% from the average. Standard deviations are frequently used by investors as a gauge for the amount of expected volatility. The quick standard deviation formula uses as input the annualized implied volatility, the number of days to expiration and the price of the equity or option.

The calculation 68 Percent uses is:

(Price) x (Implied Volatility) x Square Root (Days to Expiration / 365)

DISCLAIMER: The use of this calculator does not claim for profit. We are not responsible for any losses incurred by traders. You are advised to take your position(s) with your sense and good judgement.

MONEY IS VERY IMPORTANT. ALWAYS TRADE SAFELY.